What is a NIF Number and Why Do You Need One in Portugal?

Navigating a move to a new country comes with a myriad of questions and tasks. One of the key aspects you need to sort out before your move to Portugal is obtaining a Número de Identificação Fiscal (NIF), or Tax Identification Number. In this article, we'll delve into what exactly a NIF Number is and why having one is crucial for anyone planning to live, work, or conduct business in Portugal.

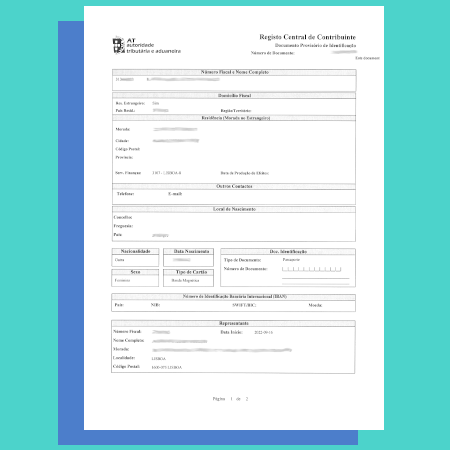

What is a NIF Number?

A NIF Number is a unique 9-digit identifier that the Portuguese government assigns to each individual and corporate entity for tax purposes. It's similar to a Social Security Number in the United States or a National Insurance Number in the United Kingdom. This number is a mandatory requirement for any financial transactions or legal activities you may engage in within Portugal, including but not limited to banking, employment, and property acquisition.

Importance of Having a NIF Number

For Financial Transactions

Having a NIF Number is mandatory for opening a bank account in Portugal. Banks require this number to report financial activities to the tax authorities. Without a bank account, functioning in the country, whether as an individual or business entity, becomes an uphill task.

For Employment

If you're planning to work in Portugal, a NIF Number is a pre-requisite. Employers need this number to correctly process tax withholdings and social security contributions. Even if you are self-employed, you'll need a NIF to report your income and expenses to the Portuguese tax authorities.

For Property and Asset Management

If you're thinking about buying a property or car in Portugal, or even simply signing a rental agreement, having a NIF Number is non-negotiable. It's essential for the transaction process and for the registration of the property or asset under your name.

Legal Obligations

While having a NIF Number eases many processes, it also comes with its set of responsibilities. Holding a NIF means that you are obligated to file taxes in Portugal if you meet certain criteria, even if you're a non-resident. Ensure you are well-informed about the tax brackets, deadlines, and other obligations tied to holding a NIF Number.

A NIF Number is your gateway to a seamless life in Portugal. Whether you're planning a short-term stay or considering long-term residency, this 9-digit number is indispensable for almost all your financial and legal transactions in the country. It's not just a number; it's your key to living and thriving in Portugal.

Make your move to Portugal hassle-free by obtaining your NIF Number in a timely manner. Trustworthy services like NifPortugal.com are here to guide you through the process, ensuring you avoid common pitfalls and fulfill all necessary requirements.